The graduates of Alliance DAO serve as valuable barometers for investor sentiment and adoption trends in the crypto landscape. The unveiling of the latest batch of the stage-agnostic crypto accelerator comes amidst a backdrop of renewed optimism in the recovering market.

Just two months ago, Bitcoin soared to its all-time high, signaling a bullish market sentiment. While the cryptocurrency has since experienced a decline, it continues to trade at significantly higher levels than during the market downturn following FTX’s collapse in late 2022. Venture capitalists are responding to this optimism by injecting capital into web3 startups, driving total fundraising in the sector to approximately $1.9 billion in Q1, marking a robust 58% increase from the previous quarter.

The resurgence in enthusiasm among proponents of web3 is evident in rallying cries such as “we are so back,” reverberating across crypto communities. However, regulatory efforts aimed at curbing the industry have not relented. In the US, Binance’s Canadian founder, Changpeng “CZ” Zhao, faces the prospect of becoming the wealthiest individual to ever serve a prison sentence. Additionally, Uniswap, known for its decentralized approach to digital assets, received a notice from the US Securities and Exchange Commission (SEC) last month.

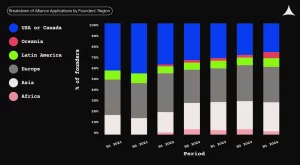

Predictably, the ongoing regulatory crackdowns in the US have had a discernible impact on the geographical composition of Alliance DAO’s applicant pool.

Image Credits: Alliance DAO

According to a graph shared by Qiao Wang, one of the founding partners of Alliance DAO, founders based in North America represented 45% of the accelerator’s applicants in H2 2021. However, this figure plummeted to just 26% in H1 of this year.

“Essentially, the US is witnessing a decline in market share for crypto founders over the past three years. This is likely attributed to 1) regulatory constraints and 2) the emergence of product-market fit in developing economies,” Wang conveyed to us via email.

Undoubtedly, the accelerator has observed a steady rise in interest from Asia, which accounted for 24% of all applications in H1 2024, compared to 14% in H2 2021.